Acanego Services

We specialise in mobile game development, integrating financial metaphors directly into gameplay mechanics. Our team transforms complex trading concepts into intuitive user experiences for next-generation gaming platforms.

Candlestick Development Phases

We map our development lifecycle to trading candlestick patterns. This visual metaphor helps stakeholders understand project momentum, volatility, and critical decision points at a glance.

Foundation & Architecture

Represents the initial commitment to core engineering. A strong "body" indicates robust backend infrastructure, while the "wick" represents early QA stress testing.

- ✓ Server stack selection

- ✓ Database schema finalisation

- ✓ Security baseline audit

Rapid Iteration Cycles

The current phase "engulfs" the previous scope. High-volume feature integration occurs here. We prioritise velocity while maintaining code coverage above 90%.

- ✓ UI/UX implementation

- ✓ Engine integration (Unity/Unreal)

- ✓ Asset pipeline optimisation

Market Equilibrium & QA

A moment of indecision and balance. Development pauses to let QA "catch up". User feedback is analysed before the next major push. No new features are added during this phase.

- ✓ User acceptance testing

- ✓ Performance profiling

- ✓ Go/No-Go decision making

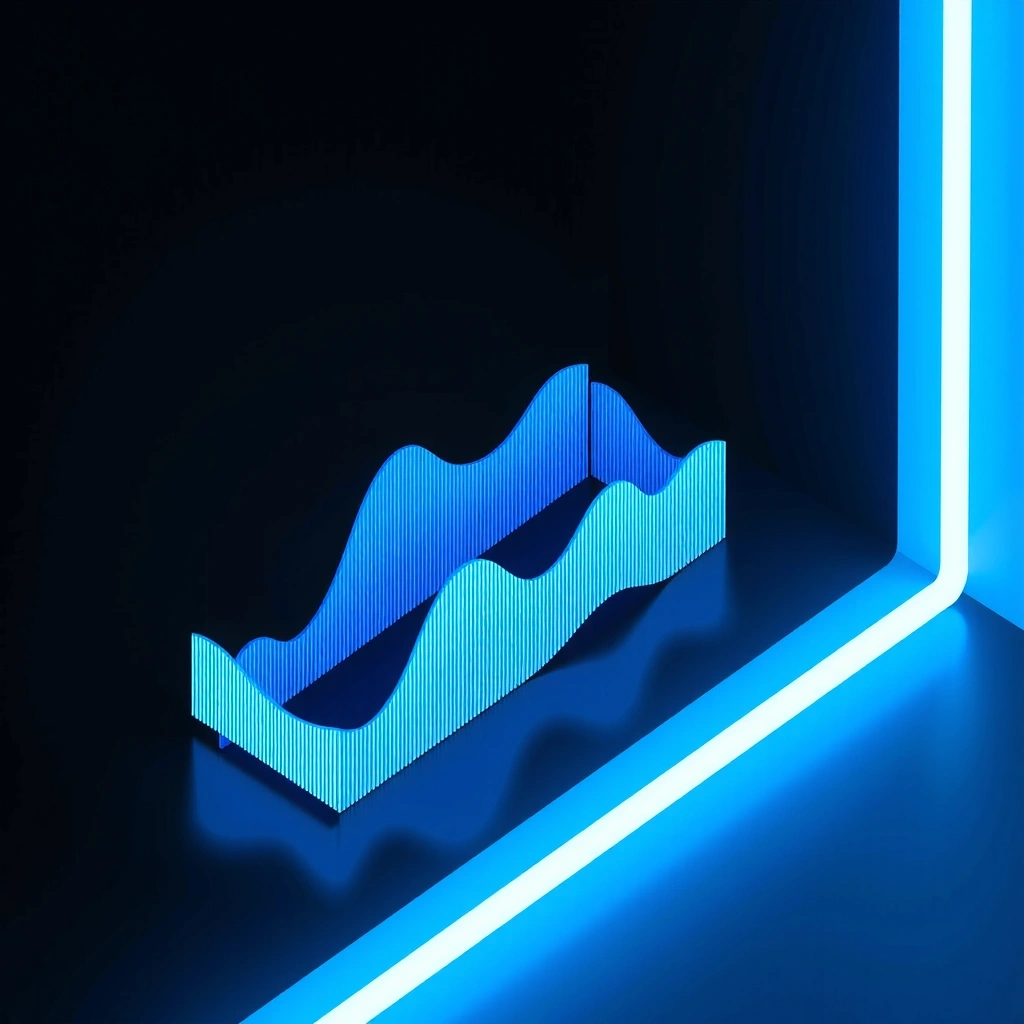

Traffic & Engagement Metrics

Our pre-launch simulations use synthetic data to model player retention and engagement curves. This static graph illustrates a typical 90-day trajectory for a mid-core mobile title, highlighting the critical Day 7 and Day 30 retention cliffs.

The vertical spikes represent major content updates, while the baseline trend demonstrates organic growth through social mechanics. We use these models to set realistic KPIs before a single line of code is written.

Interactive Pattern Simulator

Hover over the visualisations below to interpret common patterns used in our project risk assessment. This is a static educational tool to align our language.

The Hammer

Shooting Star

Marubozu

Core Service Offerings

We provide end-to-end development, focusing on mobile platforms and financial gamification mechanics.

Rapid Prototyping

Validate concepts in 2-4 weeks using our custom wireframing toolkit. We simulate market mechanics before full production.

Engine Integration

Deep knowledge of Unity and Unreal. We handle middleware integration for analytics, monetisation, and server-side authoritative multiplayer.

UX for Finance

Specialised UI patterns for high-density data. We design interfaces that translate complex candlestick data into intuitive gestures.

Data Analytics

Custom dashboards for tracking user behaviour. We identify volatility in retention and provide static reporting for stakeholders.

The Acanego Field Guide

Understanding the "Candlestick" methodology is crucial for our clients. Unlike traditional waterfall or agile methods, we treat project phases as market indicators. This guide explains how to read our reports.

Why Volatility Matters

In game development, a "smooth" graph is often suspicious. We expect volatility—sharp rises in feature completion followed by QA corrections (the "wick"). This represents a healthy, rigorous development cycle.

Decision Criteria

- Body Length: Correlates to raw output volume. Short bodies indicate blocked tasks or scope creep.

- Upper Wick: Represents QA rejections or bugs found. Long wicks are good (many bugs caught).

- Lower Wick: Represents technical debt incurred. Minimising this is a priority.

Myth vs. Fact

"No bugs means we are ahead of schedule."

A complete lack of upper wick in our charts usually means QA isn't testing hard enough. We look for high rejection rates in early stages.

"Candlesticks are only for finance."

The pattern applies to any high-variance process. Game development is effectively a market of ideas competing for resources.

Key Terms

How It Works

Our workflow is transparent and metric-driven.

1. Define & Measure

We establish baseline metrics for user acquisition cost and lifetime value. The initial candle is "forged" here.

2. Validate Assumptions

Rapid prototyping tests the "body" of the candle. We push code to see if the structure holds under load.

3. Integrate & Simulate

We connect the candlesticks. Backend talks to frontend, analytics tracks the wicks. We simulate the market.

4. Launch & Review

The market decides. We monitor the closing price (retention) and prepare the next candle for the next update cycle.

Start a ProjectSignals of Quality

Indicators of reliability based on our operational history.

Scenario Transparency

We provide "What if" analysis in our reports. Example: "If Day 7 retention drops below 20%, we trigger the 'Hammer' protocol to reinforce the backend."

Benchmarks

Simulated load tests show that our architecture sustains 500 concurrent users per CPU core with sub-50ms latency, verified by static profiling.

Compliance

We strictly adhere to age-gating requirements for financial simulation games. All products include clear "18+" branding and PEGI compliance checks.

Data Privacy

Our analytics stack is GDPR compliant. User data is hashed and never sold. We focus on aggregate retention curves, not individual tracking.

Uptime

During the "Marubozu" phase (final polishing), we target 99.9% uptime in staging environments to ensure launch stability.

Code Hygiene

We maintain a debt-to-feature ratio of < 0.5. This means for every two features, we refactor one piece of legacy code to keep the candle "clean".

Need a custom solution? Our standard engagement starts with a 2-week discovery phase.